professional tax receipt quezon city|Getting a Professional Tax Receipt (PTR) in Quezon City (2022 Update!) : Baguio CITY TREASURER’S OFFICE. STEPS FOR ONLINE PAYMENT: Register or Log-in to QC E-Services. From the list of services, choose and click ‘Business Tax Payment’. A step .

NLCB Play Whe Result For today is announced now. You can check the Play Whe results 2024. Play Whe results based on the daily draw . also known as “china-man-zombie,” is based on the original play marks. The .

professional tax receipt quezon city,PAYMENT OF MISCELLANEOUS TAXES & FEES. Collection of regulatory fees and various user/ service charges as required by law and imposed by revenue generating .

Examining books of accounts of business operators in Quezon City to determine .

CITY TREASURER’S OFFICE. STEPS FOR ONLINE PAYMENT: Register or .What Is a Professional Tax Receipt (PTR)? Who Is Required To Obtain a PTR? Who Is Exempted From Obtaining a PTR? What Are the Requirements for Obtaining PTR? . Examining books of accounts of business operators in Quezon City to determine the correct gross receipts of the business relative to its declaration in their .CITY TREASURER’S OFFICE. STEPS FOR ONLINE PAYMENT: Register or Log-in to QC E-Services. From the list of services, choose and click ‘Business Tax Payment’. A step .

Registration and Permitted Activities: Only businesses (including sole proprietors), and other entities or institutions based in the Quezon City, Philippines are .Getting a Professional Tax Receipt (PTR) in Quezon City (2022 Update!) Registration and Permitted Activities: Only businesses (including sole proprietors), and other entities or institutions based in the Quezon City, Philippines are . It is very easy to apply for a Professional Tax Receipt in Quezon City. To apply go to the Miscellaneous Section of the City Treasury Office. Proceed to Window 12 .Per a posting at that Quezon City Hall, to pay for your Professional Tax Receipt live, you can send and email to the Quezon City Treasurer’s Office at [email protected]. Prepare .

A Professional Tax Receipt is an annual fee that every professional must pay. The amount due is not more than Three Hundred Pesos (P300.00) per year. You .

PTR or professional tax receipt is proof of your annual payment of professional tax. Section 139 of the Local Government Code 1 mandates all provincial . The Professional Tax Receipt Philippines is a mandatory tax that professionals pay in the Philippines. . DIGIDO FINANCE CORP. Units P107003R, P107007R, P107008R, Level 7 Cyberpark Tower1, 60 .

In addition to online business permit application, business owners can now also request and pay for their business tax assessment without making a trip to the city hall through the QC E-Services platform. Mayor Joy Belmonte said this move is part of the streamlining efforts of the city along with the online business permit

Every January Professionals should get a new Professional Tax Receipt (PTR). This requirement is for people who are 1. PRC License and IBP License holder 2. Residing or Working in Quezon City If you .

Quezon City E-Services For any inquiries, please call 122 or email . We shall not liable for your non-receipt of notices due to network outage, power outage, device loss, device incompatibility, incorrect contact details provided, network and/or firewall restrictions, and other issues which are beyond our control. .

PTR or professional tax receipt is proof of your annual payment of professional tax. Section 139 of the Local Government Code 1 mandates all provincial governments to charge annual professional tax to individuals engaged in professional practice that requires government examination. If you are a professional under the . Paspas Permit: How to Request and Pay for Your PTR Online

Step 3. Get OTR (Occupational Tax Receipt) Since online freelancers don't need DTI registration and mayor's permit, BIR will require you to get PTR (Professional Tax Receipt) or OTR (Occupational Tax Receipt) from your municipal or city hall. Since we don't have professional license, it is better to get an OTR instead.

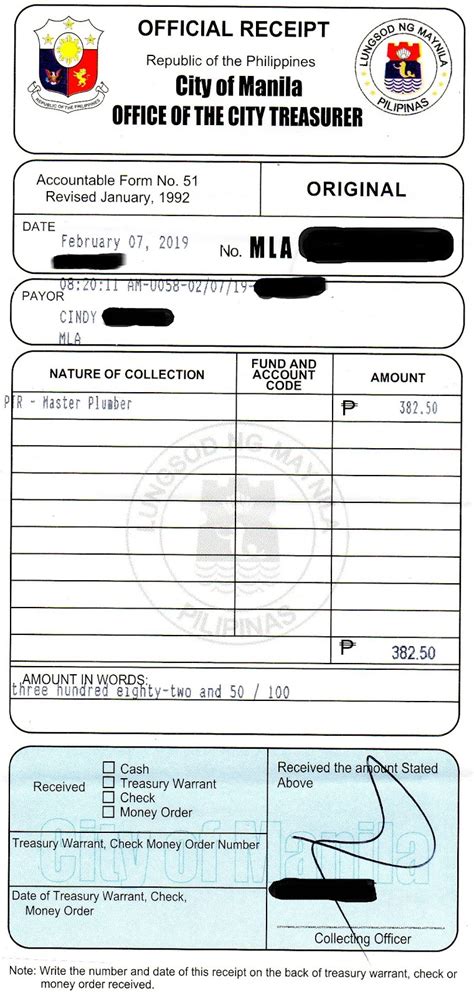

Facebook Twitter Instagram Office HoursMonday to Friday 8:00 AM - 5:00 PM ABOUT US Description The Quezon City Business Permit and Licensing Department (BPLD) provides effective and efficient systems, procedures, and practices in the issuance and renewal of business and occupational permits. BPLD is responsible for regulating . Obtain Your Professional Tax Receipt; One general requirement for doctors applying for a registration with BIR is a Professional Tax Receipt (PTR). Fundamentally, PTRs are available from the Treasury Department of the City Hall where you live. To get a PTR, simply present your PRC license and pay for the corresponding fee, which ranges .professional tax receipt quezon city Getting a Professional Tax Receipt (PTR) in Quezon City (2022 Update!) A Professional Tax Receipt is an annual fee that every professional must pay. The amount due is not more than Three Hundred Pesos (P300.00) per year. You mus. Once your number is called, hand over the last year’s receipts. This will make it easier for the person-in-charge to check your property records. . For faster transactions, bring the last paid tax .Quezon City Department or Office involved:CITY TREASURER’S OFFICE The Community Tax Certificate, also referred to as Cedula, is essential for most government transactions, serving as both a primary and secondary form of identification. Individuals or corporations receive this certificate upon paying the community tax, which can be done at the .professional tax receipt quezon city I went to Manila City Hall (last February 7, 2019) and headed to City Treasurer's Office and filed for my RPT. Since I failed to pay my tax on or before January 31, 2019..Quezon City Department or Office involved:BUSINESS PERMIT AND LICENSING DEPARTMENTCITY TREASURER'S OFFICE Filing a renewal application is required one (1) year from the issuance date of your permit. REQUIREMENTS: Official Receipt (machine validated) issued on the current year, from the City Treasurer's Office Barangay . HOW TO: Obtain a Professional Tax Receipt (PTR)

4.Preceding Year’s Tax Bills and Official receipts City Treasurer’s Office 5 Preceding Year’s Tax Bills and Official receipts Other LGUs 6.Preceding Year’s Certified Breakdown of Sales, if there are two or more lines of business /2 or more branches Business owner 7.Preceding Year’s Value Added Tax Returns, Percentage Tax Returns,3.Receive Professional Tax receipts Renewal: Lawyers previous/currently employed in gov’t present Service Record, original latest PTR and IBP card 1. Verify from the record of the previous payment (if applicable) 2.Accept payment 3.Issue Professional Tax Receipts ₱ 300.00 (plus penalty if not updated; 25% + 2% monthly surcharge) Additional

professional tax receipt quezon city|Getting a Professional Tax Receipt (PTR) in Quezon City (2022 Update!)

PH0 · Quezon City

PH1 · QC E

PH2 · Professional Tax Receipt (PTR) made easy

PH3 · PAYMENT OF MISCELLANEOUS TAXES & FEES

PH4 · PAYMENT OF MISCELLANEOUS TAXES & FEES

PH5 · P.T.R. Renewal at Quezon City Hall

PH6 · How to Pay your Business Tax

PH7 · How To Get Professional Tax Receipt (PTR): An Ultimate Guide

PH8 · Getting a Professional Tax Receipt (PTR) in Quezon City (2022 Update!)

PH9 · Getting a Professional Tax Receipt (PTR) in Quezon City (2022

PH10 · City Treasurer’s Office